Pros And Cons Of Getting An Instant Personal Loan Online

In our fast-paced world, the need for swift access to financial assistance has fueled the rise of online personal loans. These modern financial tools offer quick relief during monetary crunches. Quick loans also come with their own set of unique pros and cons, just like every other financial tool we make use of. In this blog post, we will delve deep into the pros and cons of instant personal loan, offering valuable insights to empower your financial decisions.

Pros of Instant Personal Loans

Rapid Approval and Disbursement

The allure of an online loan app lies in its remarkable speed of approval. Traditional banks may subject you to lengthy waiting periods, but instant personal loan apps can approve in a matter of hours. This rapid process is a game-changer during emergencies.

Unmatched Convenience

Applying for an instant loan can be accomplished from the comfort of your own home. Say goodbye to the days of visiting banks, filling out long application forms, submitting loads of documents, and enduring long queues.

Tailored Loan Amounts

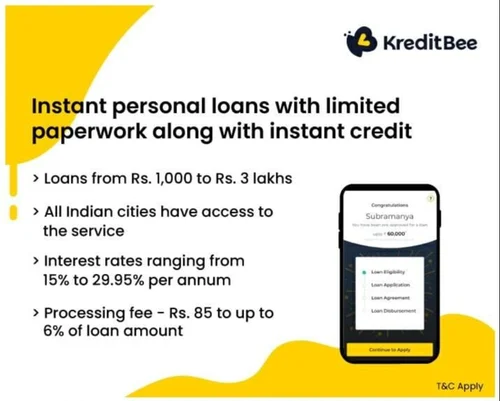

Online lenders often offer a wide spectrum of loan amounts, empowering borrowers to select the sum that perfectly aligns with their requirements. This flexibility proves invaluable when confronted with unforeseen expenses.

Credit Score Consideration

Many online lending apps take a holistic approach when assessing loan applications. They consider factors beyond just your credit score, which can be a lifeline for users with less-than-perfect credit histories.

Cons of Instant Personal Loans

Slightly Higher Interest Rates

It’s essential to recognize that online quick loans typically come with slightly higher interest rates as compared to traditional loans for business. Borrowers must evaluate their ability to repay carefully to avoid descending into a debt spiral.

Shorter Repayment Terms

Most online lending platforms feature a shorter repayment term from 6 to 12 months. At the same time, this can be advantageous in swiftly clearing debt.

Potential for Unscrupulous Lenders

The online lending landscape harbors its share of unscrupulous players. Thus, diligent research is critical to identifying a reputable lender and avoiding the pitfalls.

Credit Score Implications

Failure to meet repayment obligations for an instant personal loan can impact your credit score adversely.

Online quick loans are a powerful financial tool during times of monetary strain, but they should be used judiciously. It is imperative to weigh the advantages and drawbacks before committing. To navigate this digital financial landscape adeptly, consider some tips given as follows:

- Do some in-depth research and look for the best options that suit your needs.

- Borrow responsibly and take only what you need and can repay without any trouble.

- Make a repayment plan and proceed with timely monthly repayments.

Final Thoughts:

In conclusion, online personal loans provide a valuable financial lifeline, although they are accompanied by their own set of pros and cons. An informed, prudent approach is critical to guarantee that they align with your financial objectives. Remember that the decision to acquire an instant personal loan is a crucial one, capable of influencing your financial future.

Therefore, tread carefully and seek counsel from a financial advisor when uncertain. Your financial well-being is a treasure worth preserving.