Simplify Your Finances With A Smart Business Banking App

Among the most difficult parts of owning a company is probably handling money. Particularly for small and medium-sized businesses, financial management sometimes entails juggling several chores ranging from loan securing to spending tracking. Fortunately, current technology is changing this scene. Designed to simplify financial processes, a business banking app is a creative solution providing business owners more convenience and control. Let’s investigate how such an app might simplify your company’s financial situation.

Understanding a Business Banking App:

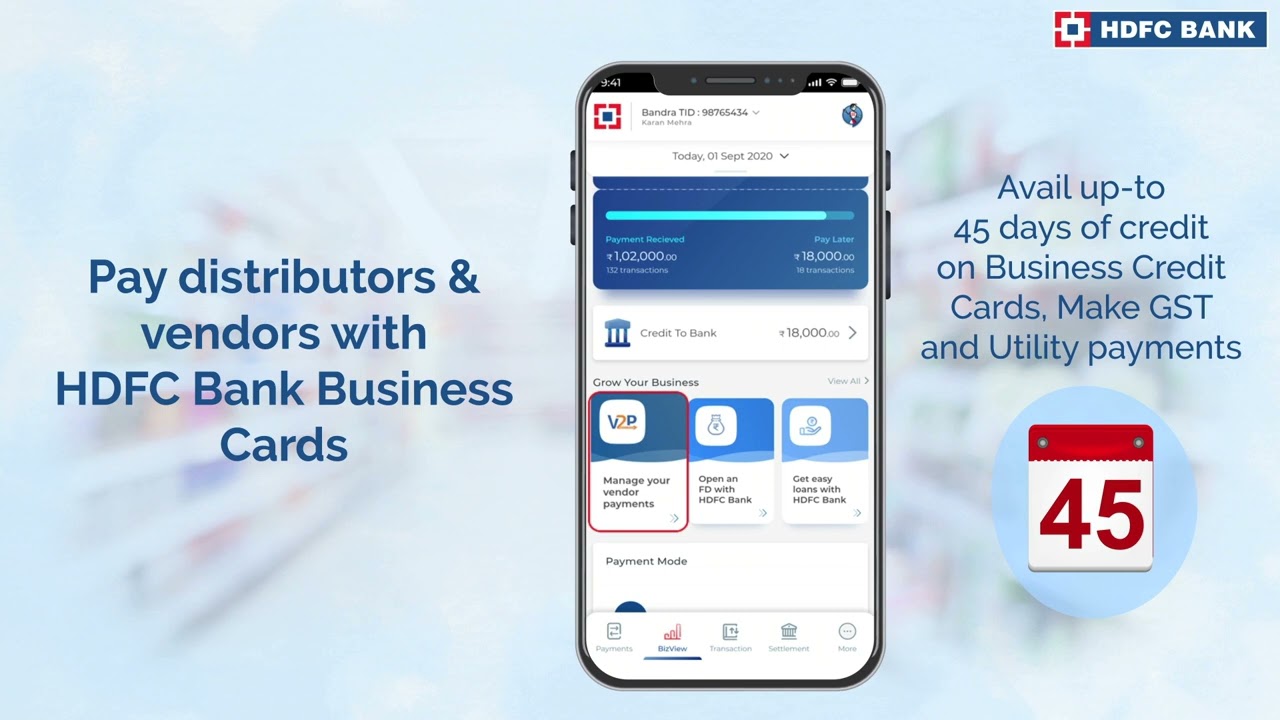

A corporate banking app is a digital tool combining all necessary banking functions into one, simple interface. From your mobile device, you can do chores such as account management, financial transfers, and even business loan app processing rather than visiting a branch of a commercial bank for transactions or questions. These programs offer quick, safe, and effective answers for daily financial problems, catered to the particular demands of business owners.

Fast and simple access to instant business loans:

A business banking app’s capacity to provide a fast business loan is among its most outstanding qualities. Applying for a loan in conventional banks sometimes entails protracted waiting times and plenty of documentation. This delay can be negative for companies requiring fast finance. App simplicity allows company owners to apply for funds in minutes and get decisions quickly.

For instance, a rapid business loan can offer the required support without interfering with operations if a small company needs quick money to replace inventory or grab a profitable opportunity. These loans have variable periods, which lets companies properly handle their payback plans.

The Part Business Loans Apps Play in Contemporary Finance:

An app for business financing has transformed companies’ attitude to capital. Unlike conventional approaches, where qualifying criteria can seem daunting, these applications provide customised lending solutions fit for each corporate need. Leveraging technology, the app assesses the financial situation of a business and suggests suitable lending products.

These programs also help to clarify the borrowing procedure. Users may check loan application status, review repayment schedules, and get customer service as needed. This flawless experience removes the anxiety usually connected with borrowing, therefore freeing companies to concentrate on expansion rather than on negotiating difficult procedures.

Adopting digital banking offers businesses advantages:

Using business banking software will help companies of all kinds in many different ways. It improves convenience by allowing 24-hour financial service access. Everything can be done—checking account balances, moving money, qualifying for a business loan—without ever leaving your office.

These programs also give insightful financial analysis. Many provide tools for tracking cash flow, evaluating spending, and building budgets. These tools enable companies owners to make informed decisions based on data that support long-term viability. Furthermore, sophisticated security systems guarantee that all data and transactions are protected, thus providing users with a financial management piece of mind.

Why Apps for Business Banking Reflect the Future:

Dependent just on conventional corporate banks is insufficient in an environment going more and more digital. Technology’s inclusion into financial processes is not only a trend; it’s a need. While improving productivity, a business loans app or a whole business banking software saves time and effort by simplifying difficult chores.

Using such technologies is a calculated action for company owners trying to keep ahead in the competitive scene of today. A business bank app is the ideal friend on your entrepreneurial path whether your needs are for a quick business loan or better financial management.

Conclusion:

Handling company money need not be a pain. A business banking app provides a useful and quick fix that lets companies easily address their financial needs. From recording everyday activities to qualifying for corporate financing, these programs provide unmatched simplicity and control. You should welcome the ability of a business banking app if you are ready to streamline your financial processes and concentrate on expansion of your company.