Why a Trading App Is the Future of Personal Investing

The shift in how individuals manage their money has taken a new direction with the rise of digital tools. A trading app is steadily becoming the preferred pathway for personal investing because it allows people to handle their portfolio from anywhere with clarity and convenience. Today, many investors begin their journey through a Demat Account Platform as it simplifies holding securities in digital form while allowing instant access to essential investment options. Most trading apps also enable users to participate in opportunities such as IPO Investment without the need for physical paperwork or multiple intermediaries.

As investing continues to evolve, the role of a trading app is no longer limited to placing orders. It has become a complete system that helps individuals learn, evaluate, and invest according to their financial comfort. The growing interest in IPO Investment and the increased reliance on a Demat Account Platform reflect how the investing environment is becoming more structured and streamlined for everyday participants.

The Growing Importance of Digital Investing

Digital investing has made financial participation accessible to a wider audience. The ability to buy and sell instruments from a mobile phone has removed the earlier limitations of location, physical documentation, and lengthy processing. A trading app acts as a central place where one can view holdings, study price movements, plan strategies, and manage risk without any dependence on in-person support.

People who previously avoided investing due to complexity now find the process manageable. Features such as digital onboarding through a flexible Demat Account Platform encourage newer investors to begin their journey. This transformation has opened the door for more individuals to take part in wealth-building practices that were once viewed as complicated or time-consuming.

Why a Trading App Works Better for Modern Investors

Accessibility at Any Moment

One of the strongest advantages of using a trading app is constant accessibility. Investors no longer need to wait for office hours or depend on a physical advisor. Market updates, performance graphs, and portfolio insights are available instantly. This freedom allows users to make decisions based on real-time conditions rather than delayed updates.

Simple Portfolio Management

Managing a broad portfolio becomes easier when everything is stored in digital form. With the help of a Demat Account Platform, all securities remain organized and accessible. A trading app presents these holdings in a structured dashboard so users can view allocations, recent changes, and overall performance. This clarity encourages mindful decision-making.

Smooth IPO Participation

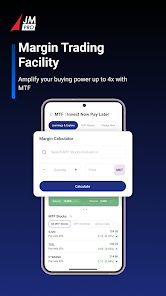

IPO Investment has gained traction because many investors seek early entry into potential growth opportunities. A trading app simplifies this process by allowing people to apply for public offerings directly through their phone. They can track issue dates, allotment status, and listing details in one place. This straightforward approach has made IPO Investment more common among beginners and experienced users alike.

How Trading Apps Enhance Decision-Making

A trading app provides analytical tools that help users make informed decisions. These tools include charts, price comparisons, historical data, and news updates. Instead of searching across multiple platforms, investors can understand market patterns within a single interface. When paired with a Demat Account Platform, the experience becomes more connected as execution and storage happen in one environment.

Many apps also allow users to set alerts for price changes or market movements. These notifications help them respond to opportunities without constantly monitoring the screen. This level of control adds precision to the investment process.

The Role of Education Within Trading Apps

Earlier, investors had limited access to reliable learning material. Today, trading apps include educational segments that explain how markets operate, how instruments behave, and how a Demat Account Platform fits into the overall process. These guides help users develop confidence and a long-term view of financial planning.

Information about IPO Investment is also presented in a simple manner so users can understand aspects like subscription numbers, offer price, and timelines. The combination of learning and execution in one place encourages thoughtful participation.

Security and Transparency

Safety remains a primary concern for anyone handling digital finances. Modern trading apps use multi-layer security systems, verification methods, and encrypted communication channels to protect user data. Every action—including order placement, fund transfer, or IPO Investment application—is recorded clearly, reducing confusion and errors.

Transparency is another significant factor. Investors can track the status of trades, view charges, and understand settlement timelines. With the support of a trusted Demat Account Platform, they can verify holdings at any time, ensuring complete clarity.

Why Trading Apps Are Becoming the Long-Term Choice

Trading apps continue to evolve with features that match user expectations. The ability to manage funds, track global events, participate in IPO Investment, and maintain holdings on a secure Demat Account Platform creates a reliable ecosystem for long-term investing.

Additionally, new investors prefer platforms that reduce multi-step processes. A trading app brings everything together—market access, analysis, storage, and order execution—making it a long-term tool rather than a temporary solution.

Conclusion

The rise of digital tools has shaped how modern investors interact with markets, and a trading app is at the center of this shift. With simple access to essential services, a streamlined Demat Account Platform, and direct options for IPO Investment, users can manage their finances with greater independence. This structure not only simplifies investing but also encourages people to build long-term financial habits with confidence.

As more individuals begin their financial journey, the role of a trading app will grow even stronger. Its ability to support IPO Investment, maintain digital holdings, and offer organized portfolio management ensures that it remains a dependable choice for everyday investors. The future of personal investing is rooted in digital convenience, and trading apps continue to define this direction with clarity and purpose.